Freedom Bank is Focused on You

- (406) 892-1776

- Routing # 092905456

Communities are doing a lot to support one-another in these unprecedented times, but unfortunately scammers are taking advantage of fears surrounding the Coronavirus (COVID-19). Some scams purport to be providing relief or cures. Some scammers are preying on the generosity of people and asking you to donate to victims or relief funds.

Please don’t fall victim to these frauds and crimes. Independently verify the identity of any company, charity, or individual that contacts you regarding COVID-19.

If you see these frauds being attempted or if you are victimized by these frauds, please report them to:

The Montana Department of Labor & Industry (DLI) announced on June 12th, 2020 that the agency has prevented over $220M in fraudulent Unemployment Insurance (UI) payments since April 28. Scammers are utilizing information obtained from various large-scale data breaches (such as Equifax) to file for fraudulent unemployment claims. If you receive a UI identity verification letter and have not filed for benefits or believe you may be a victim of unemployment or identity fraud to report it at http://uid.dli.mt.gov/report-fraud immediately.

The Montana Department of Labor & Industry (DLI) announced on June 12th, 2020 that the agency has prevented over $220M in fraudulent Unemployment Insurance (UI) payments since April 28. Scammers are utilizing information obtained from various large-scale data breaches (such as Equifax) to file for fraudulent unemployment claims. If you receive a UI identity verification letter and have not filed for benefits or believe you may be a victim of unemployment or identity fraud to report it at http://uid.dli.mt.gov/report-fraud immediately.

In some instances, the FTC says unemployment payments may be sent to the real person instead of the impostor. The criminal may attempt to contact the individual whose information they stole pretending to be a government official and say the funds were sent by mistake.

“If you get benefits you never applied for, report it to your state unemployment agency and ask for instructions,” the FTC said. “Don’t respond to any calls, emails, or text messages telling you to wire money, send cash, or put money on gift cards. Your state agency will never tell you to repay money that way. Anyone who tells you to do those things is a scammer. Every time.”

The Federal Trade Commission’s identity theft website at identitytheft.gov also provides resources and a detailed step-by-step process for reporting and protecting against identity theft.

If you receive calls, emails, or other communications claiming to be from the Treasury Department and offering COVID-19 related grants or stimulus payments in exchange for personal financial information, or an advance fee, tax, or charge of any kind, including the purchase of gift cards, please do not respond. These are scams.

Scammers posing as national and global health authorities, including the World Health Organization (WHO) and the Centers for Disease Control and Prevention (CDC), are sending phishing emails designed to trick recipients into downloading malware or providing personal identifying and financial information.

Scammers are creating and manipulating mobile apps designed to track the spread of COVID-19 to insert malware that will compromise users’ devices and personal information. Watch out for any links texted to your Android phone promising an app to track coronavirus.

Scammers are offering to sell fake cures, vaccines, and advice on unproven treatments for COVID-19. Check reputable sources like the CDC and WHO for factual information about treatments and prevention measures.

Online sellers claim they have in-demand products, like cleaning, household, and health and medical supplies. You place an order, but you never get your shipment. Anyone can set up shop online under almost any name — including scammers.

Scammers are contacting people by phone and email demanding payment for treatment of a friend or relative that they claim was hospitalized for Coronavirus.

Scammers are soliciting donations for false “funds” for individuals, groups, and areas affected by COVID-19.

Scammers are offering online promotions on various platforms, including social media, claiming that the products or services of publicly traded companies can prevent, detect, or cure COVID-19, and that the stock of these companies will dramatically increase in value as a result. These promotions are often styled as “research reports,” make predictions of a specific “target price,” and relate to microcap stocks, or low-priced stocks issued by the smallest of companies with limited publicly available information.

Source: https://www.justice.gov/usao-wdpa/covid-19-fraud-page

Source: https://www.consumer.ftc.gov/blog/2020/03/ftc-coronavirus-scams-part-2

Our team is available to serve you as always. Our lobby is open M-F 9-5 and Saturdays 9-1. The Drive Up is open M-F 8-6 and Saturdays 9-1. Our ATM is available 24/7.

We will continue to closely monitor the situation and evaluate additional measures to support our customers and community as needs arise.

Updates will be posted here and on our Facebook and Instagram pages.

Thank you for being a valued customer.

Don Bennett, President – 406-892-6622 After Hours 406-270-1143

Max – 406-892-6631

Cameron – 406-892-6626

Trevor – 406-892-6629

Alona – 406-892-6630

Carie – 406-892-6625

Lynette – 406-892-6632

Blayne – 406-892-6634

Monday-Friday 8:00AM – 6:00PM

Saturday 9:00AM – 1:00PM

We encourage you to be vigilant and wary of attempted scams. We will never ask you to share your online banking credentials.

Download the Freedom Bank MT Mobile App. Use your phone’s camera to scan a QR code below.

Learn more about the mobile application here.

Online Banking

Online Banking‘Tis the season… for holiday scams! As the end of the year approaches, criminals are working overtime to take advantage of busy employees.

Holiday cards can spread cheer—and also malware. Criminals love to send cute Christmas and New Year’s e-cards which entice you to click a link— but once you do, your computer is infected with malware that can steal your online banking credentials, credit card numbers and more.

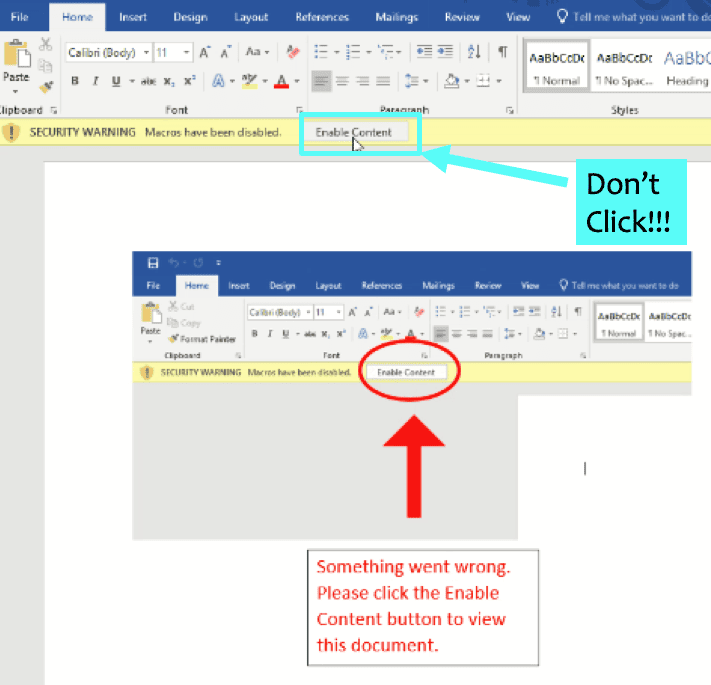

This year, the party started early, when a rash of Emotet-laced Halloween invitations was reported back in October. Recipients were invited to a “Come and say hello to your neighbors and enjoy some food and drink… Details in the attachment.” If you click on the attachment, a Word document opens, prompting the user to “Enable Content.” Once clicked, the malware is loaded onto the victim’s computer.

Days before Thanksgiving, researchers reported a surge of “Thanksgiving lures,” such as a “holiday memo” that announced office closure dates. Busy staff, making their holiday plans, were undoubtedly tempted to click without thinking, and fell victim to these holiday scams.

To protect your friends, family and colleagues, make sure everyone is familiar with the common “Enable Content” trick shown in the image below, and knows NOT to click the button.

Do those Black Friday and Cyber Monday deals sound too good to be true? Cybercriminals love to lure consumers into clicking on fake offers. Often, these phishing email perfectly mirror real email blasts sent by Amazon or other big names. This year, fake e-commerce sites are trendy holiday scams, with researchers reporting a 233% increase compared with last November.

To be safe, don’t click the link— instead, type the store’s address directly into the address bar, and then look for holiday offers on their web site. Remember, if an offer seems too good to be true, it’s probably a scam.

Gift cards are popular, both at home and in the office, as rewards for employees and convenient thank-you gifts for vendors and clients. This makes them a popular target for holiday scams. Criminals take advantage of that by tricking people into purchasing gift cards and giving them the codes to redeem them. According to the Wall Street Journal, consumers reportedly lost over $74 million in scams involving gift cards or reloadable cards in January-September of this year (an increase of $53 million compared with 2015).

In a typical scam, a criminal impersonates someone you know such as a close relative, and send emails or text messages asking you to purchase gift cards. The cards are supposedly a “reward” or a surprise — meaning that often, the victim is asked to keep the purchase secret. The victim sends the card details to the scammer, who steals them and cashes out.

To protect you and your family, make sure everyone is aware of common gift card scams, and knows to verify requests via phone before responding.

Look carefully at that ATM or point-of-sale terminal before you insert your credit or debit card. Criminals can place “skimmers” to steal your credit or debit card number as you swipe. They can also overlay a keypad to capture any PIN numbers you enter.

Check card readers and PIN pads carefully for unusual signs such as cracks, loose parts or scratches. If you notice anything suspicious, don’t use that machine. Consider using ApplePay, GooglePay, SamsungPay or similar modern payment technologies for retail purchases, since they offer extra security measures that never reveal your card number to the merchant.

Modern criminals break into ecommerce sites in order to inject snippets of code into the checkout page and steal customer card numbers. These e-skimming attacks (often referred to as “Magecart” attacks) have reached epidemic proportions, affecting retail giants such as Macy’s and Newegg, and prompting warnings from the FBI, US-CERT and others. Criminals have honed their tactics, often targeting popular third-party ecommerce software and plugins, in order to infect thousands of websites at once.

Merchants can defend against this by carefully vetting third-party code that is included in their site. Make sure your software is up-to-date, and stay apprised of any known vulnerabilities in your ecommerce platform. Have your web site tested regularly so that you are alerted to issues early on, before hackers break into your system.

For consumers, e-skimming attacks are a tricky problem, because there is no easy way to detect the malware in web sites that you visit. Carefully consider whether the online shop you use is reputable, and consider using virtual credit card numbers to reduce your risk if a site is infected. If you suspect an ecommerce site is infected, or notice fraud related to an ecommerce sale, report any incidents to www.ic3.gov.

Cybercriminals work overtime during the holidays! Share this list to keep your friends and colleagues aware of holiday scams, so everyone stays safe this season.

FRIDAY, DECEMBER 6th

LOCATED IN THE NORTH VALLEY SENIOR CITIZENS CENTER & TEAKETTLE ROOM

AWARDS FOR FLOATS; FLOAT ENTRY $10 OR FOOD ITEM FOR FOOD BANK

HEAT UP AT THE COOP AFTER THE PARADE

VISIT WITH SANTA AND WARM UP WITH A BON FIRE, HOT COCOA, CHILI &

A LIVE HOLIDAY CONCERT WITH HOLIDAY DESSERTS, CFHS CHORAL SONIFERS AND COLUMBIANS!

SATURDAY, DEC. 7TH 9:30 AM

BRUNCH WITH SANTA: TIMBERCREEK VILLAGE

MEADOWLAKE DR.

Here at Freedom Bank we want you to be safe this holiday season. We have teamed up with National Cybersecurity to make you more aware of protecting yourself online. Own IT. Secure IT. Protect IT. – has been designed to not only encourage personal accountability and proactive behavior in digital privacy, but also promote security best practices, consumer device privacy and e-commerce security.

The 16th annual National Cybersecurity Awareness Month (NCSAM) is in full swing! Held every October, NCSAM has been a collaborative effort between government and industry to raise awareness about not only the importance of cybersecurity, but also ensure that everyone has access to the appropriate resources they need to be safer and more secure online.

Below are some of the highlighted calls to action and their key messages:

We live in a world in which we are constantly connected, so cybersecurity cannot be limited to the home or office. When you’re traveling, it is always important to practice safe online behavior and take proactive steps to secure your smart devices. With every social media account you sign up for, every picture you post, and status you update, you are sharing information about yourself with the world.

Have you noticed how often security breaches, stolen data, and even identity theft, are front-page headlines nowadays? Cybercriminals attempt to lure users to click on a link or open an attachment that may infect their computers. These emails might also request personal information such as bank account numbers, passwords, or Social Security numbers. When users respond with the information or click on a link, these attackers now possess access to their personal accounts.

Today’s technology allows us to connect around the world through banking, shopping, streaming, and more. This added convenience undoubtedly comes with an increased risk of identity theft and scams. More and more home devices (such as thermostats, door locks, etc.) are now connected. While this may save us time and money, it poses new security risks.

Visit these sites to learn more:

https://niccs.us-cert.gov/national-cybersecurity-awareness-month-2019

https://staysafeonline.org/ncsam/about-ncsam/

Freedom Bank received the highest possible rating for our performance in the Community Reinvestment Act during the most recent examination by the FDIC. The Community Reinvestment Act of 1977 requires federally insured depository institutions to support the borrowing needs of the communities where they do business, including low- and moderate-income areas.

Freedom Bank received the highest possible rating for our performance in the Community Reinvestment Act during the most recent examination by the FDIC. The Community Reinvestment Act of 1977 requires federally insured depository institutions to support the borrowing needs of the communities where they do business, including low- and moderate-income areas.

The “Outstanding” rating is based on Freedom Bank’s performance under the lending, investment, and service tests. These tests examine mortgage, small business, and community development lending, community development investments, and community development services in the communities a bank serves.

Freedom Bank was recognized in these key areas:

“We don’t view community investment as a regulatory requirement,” says Freedom Bank President Don Bennett. “For us, it is just how we do business. Columbia Falls believed in us when we opened our doors as a single-wide trailer in 2005 and we work hard every day to return the favor.”

Just like many of our customers, Freedom Bank is a small business. We consider our small size and local character to be our core strengths. Bennett adds, “Freedom Bank remains committed to the continued vitality and successes of our customers, no matter where they are at in their financial journey.”

If you want the money you deposit at a bank to stay local, you can count on Freedom Bank. Give us a call or stop in today to learn more about what we offer. We want to be your bank!

Jerry Burley, assistant vice president and loan officer at Freedom Bank on Friday was awarded Notary of the Year by Montana Sec. of State Linda McCulloch.

Jerry Burley, assistant vice president and loan officer at Freedom Bank on Friday was awarded Notary of the Year by Montana Sec. of State Linda McCulloch.

Burley has been a notary since the early ‘90s, getting his start in banking fresh out of high school.

He grew up in Broadus and, following his love of accounting, took a job bookkeeping at a bank in Ashlan.

The job required him to be a notary, so he became one.

The process as he recalled it was not difficult.

“Back in the day, it was just fill out a form, and the bank paid for the bonding, and I took a training and they sent the certificate,” he said.

Being a notary is fairly simple, he said. Any time a legal document needs notarized, he confirms the ID of the person signing, keeps a log, and adds a stamp to the document confirming he notarized it.

“Jerry Burley epitomizes what it means to be Montana Notary of the Year,” said McCulloch. “He was chosen from a strong field of nominees for demonstrating exceptional services and high standards of practice.”

Montana Notary of the year nominees were evaluated on their longevity, variety of documents notarized, use of notary journal, community service, and exceptional notary service.

McCulloch started the Montana Notary of the Year award in 2009 in an effort recognize the invaluable work done by notaries in Montana.

“Notaries are the first line of defense against many types of fraud as they are responsible for determining the identity of the person who signs a document, swears an oath, or performs any of the other acts that require a notary public. I’m eager to present this award to such a deserving notary public,” McCulloch said.

Burley is involved in the community, which factored in to being named Notary of the Year.

He was a member of the Columbia Falls Chamber of Commerce for 10 years, and has served as treasurer of the Gateway to Glacier trail for the past three.

Because he was named Montana Notary of the year, Burley is automatically nominated for the National Notary of the Year award given annually by the National Notary Association.

Burley’s wife, Joanne, their daughter Kristen and granddaughter Avery were all present at the award ceremony at Freedom Bank on Friday.

Although he now works as a lender at Freedom Bank rather than the accounting and bookkeeping that first got him interested, he says that his favorite aspect of being a notary has remained the same.

“I think mainly it’s the people that come through, the conversations I have with them while they sign. It’s just getting to know people,” he saidJERRY SEC DON

Freedom Bank received notification that a large credit card processing center that services several businesses in the Flathead Valley was compromised sometime in November 2013. As a result, persons that used their debit or credit cards at these businesses may be exposed to fraudulent activity. In cooperation with law enforcement and other financial institutions in the Flathead Valley, Freedom Bank immediately initiated a debit card shutdown for those cards that may have been exposed to the security breach. This had to be done immediately in order to protect everyone that was exposed.

Please understand that this breach had nothing to do with the bank’s security systems and has impacted every bank in the Flathead Valley and thousands of individuals. Our staff has been working diligently trying to notify our customers, but due to the high volume of cards shut down, we did not have enough staff, or time, to call everyone before the cards were shut down. Shutting the cards down protected both our customers and Freedom Bank. We apologize for any inconvenience. New cards have been ordered and customers should be receiving them within 7-10 business days. Thank you for your understanding.

Please call us at (406) 892-1776 if you have any questions.

The Glacier National Park Quarter was released in 2011 as part of the America the Beautiful Quarters Program. The quarter depicts Glacier’s prominent glacially carved valleys, Mount Reynolds peak, the iconic mountain goat and sub-alpine conifers.

Freedom Bank still has a limited supply of collectors sets of the Glacier National Park quarter for purchase. Add to your collection or mark a gift off of your shopping list for that special coin collector in the family by contacting Freedom Bank.

By operation of federal law, beginning January 1, 2013, funds deposited in a non-interest bearing transaction account (including an Interest on Lawyer Trust Account) no longer will receive unlimited deposit insurance coverage by the Federal Deposit Insurance Corporation (FDIC). Beginning January 1, 2013, all of a depositor’s accounts at an insured depository institution, including all non-interest bearing transaction accounts, will be insured by the FDIC up to the standard maximum deposit insurance amount($250,000), for each deposit insurance ownership category. For more information about FDIC insurance coverage of non-interest bearing transaction accounts, visit http://www.fdic.gov/deposit/deposits/unlimited/expiration.html.

You might find yourself wondering just how much of your money is covered by the FDIC since the expiration of the temporary FDIC insurance coverage. The FDIC recently rolled out their Electronic Deposit Insurance Estimator (EDIE), you can find this useful tool at www.fdic.gov/edie/index.html. If you discover that your assets are not fully covered or you would like to more effeciently organize your assets please give Freedom Bank a call at (406)892-1776 and one of our personal bankers will be happy to assist you in your financial planning.