Freedom Bank is Focused on You

- (406) 892-1776

- Routing # 092905456

Update: Happy April Fools’ Day!

Columbia Falls, MT – In an inspiring display of both business growth and physical agility, Freedom Bank has officially outgrown its office space, prompting an innovative solution: relocating the Bank President’s desk to the mezzanine level above the teller line.

Bennett admiring the Freedom Bank lobby from his new office atop the mezzanine.

President Don Bennett, a staunch advocate for open-door policies (now an open-air policy), has reassured customers that he remains as accessible as ever… provided they’re willing to scale a fifteen-foot ladder to reach him.

“For years, I’ve said my door is always open,” Bennett said, shouting slightly to be heard over the customers below. “And now, my entire office is open!”

Hauf on Bennett’s shoulders to mount the American flag on the trailer bank in 2005.

No stranger to defying gravity, Bennett earned his pilot’s license in his early twenties and promptly used it to impress his now-wife, Barbra, by whisking her into the skies in a Cessna 172. “He told me he wanted to show me the world from a new perspective,” Barbra recalled. “In hindsight, I should have realized that meant he would eventually run a bank from a balcony.”

Bennett’s history of altitude-related decision-making doesn’t stop there. In 2005, he successfully convinced Board member Ron Hauf to scale the bank’s temporary headquarters – affectionately referred to as “the trailer bank” – to mount an American flag. “He has an uncanny ability to always look toward the horizon,” Hauf said. “And now that I think about it, that might just be because he’s physically higher than the rest of us most of the time.” Hauf, pointing to an old photograph with him on Bennett’s shoulders for the stunt, added, “But hey, at least he believes in lifting others up.”

Tin can phone system.

To accommodate various levels of customer comfort, the bank has introduced two communication options: an extension ladder leading up to Bennett’s desk for those who prefer a face-to-face experience, and a state-of-the-art tin can telephone system for those less inclined toward heights. “The string is top-of-the-line,” Bennett assured skeptics. “Very little lag.”

Longtime loan customer Frank Delaney attempted the ladder climb to discuss financing for his expanding business but abandoned the mission halfway up. “I made it to the third rung, and that was plenty,” he said. “Luckily, I was able to holler my concerns up to Don, and he hollered back.”

In an effort to streamline communications even further, the bank is considering implementing a pulley system for document exchanges and a megaphone for addressing customer inquiries. Additionally, for the safety-conscious, Freedom Bank is proud to introduce a complimentary parachute policy for first-time ladder climbers. “We want our customers to feel secure, both financially and physically,” Bennett explained. “The parachutes are small, but they should slow folks down enough to enable a graceful landing near the fireplace.”

Bank employees have mixed feelings about the change. Lead Teller Lisa Decker reports occasional heart palpitations when Bennett leans too far over the mezzanine’s ledge to pass down loan advance slips. “I appreciate how engaged he is,” Decker said, “but I’d appreciate it more if he wore a safety harness.”

Despite logistical concerns, Bennett remains enthusiastic about the setup. “It’s a symbol of how high we’re aiming as a bank,” he said, standing triumphantly atop his new executive perch.

For now, the citizens of Columbia Falls will have to adjust to their high-flying banking experience – just be sure to hold the ladder steady for the next customer in line.

This year marks a significant milestone for Freedom Bank as we celebrate our 20th anniversary. Since opening our doors in 2005, we’ve been dedicated to growing alongside you and supporting local businesses and initiatives.

We invite all community members to participate in our 20th-anniversary events. Your support has been the cornerstone of our success, and we can’t wait to celebrate this achievement with you. Stay connected with us through our website and social media channels for event updates and more information.

📅 Monday, April 7 through Thursday, April 10: Stop by the bank for coffee, cookies, and opportunities to win in our daily drawings and giveaways.

🍔 Friday, April 11: Join us for a celebratory BBQ starting at 11:00AM. We’ll be serving up hot dogs and hamburgers—rain, shine, or even snow!

As we celebrate this milestone, we remain committed to the values that have guided us for the past 20 years: personalized service, community involvement, and financial solutions tailored to your needs. We look forward to continuing our journey with you, fostering growth and prosperity in Columbia Falls and beyond.

Today, one of the most pressing concerns for the Flathead Valley is the availability of affordable housing. Scammers will try to exploit people’s desperation by using real rental listings and post them on various online platforms, such as social media groups, the marketplace, and more. A listing will look like a fantastic deal and the scammer will try and rush you into paying an application fee, deposit, and/or first month’s rent with promises to provide keys later. However, once they’ve received the money, scammers disappear leaving you without your money and with no place to live.

To avoid losing time and money to scammers use the following steps:

Additional warning signs:

Steps to take if you’re a victim of a rental scam:

Key Takeaways

If it seems too good to be true, then it probably is. Always be weary if someone is trying to invoke a strong emotion (i.e., fear, anger, happiness, excitement, etc.), take a moment to reassess and do further research.

Through the gift of a new toy or book, Marine Toys for Tots’ programs deliver joy and send a message of hope to America’s disadvantaged children.

Freedom Bank is a donation site, accepting toys and books for children up to 16 years old. New, unwrapped gifts can be dropped off between November 1 and December 17, 2024 at Freedom Bank; 530 9TH ST W, Columbia Falls, MT 59912.

Every child deserves to experience holiday joy. Last year, the Marine Toys for Tots Program fulfilled the Christmas holiday dreams of nearly 10 million children in need. If you prefer to make a monetary donation, you can do so on the local website: https://columbia-falls-mt.toysfortots.org/

It’s that time of year and we can’t wait to celebrate!

The community celebration began in 1956 to mark the prosperity brought about by industrial expansion, which included the railroad, lumber business, and the Anaconda Aluminum Company.

Freedom Bank is honored to have been a part of Columbia Falls’ growth over the past 19 years. Just like many of our customers, Freedom Bank is a local business. It has been inspiring to participate and watch the community grow as we support it. As a small community bank, Freedom Bank provides personalized financial guidance tailored to the unique needs and goals of each business owner and individual and offers customized solutions to help the community achieve their goals. Freedom Bank recently expanded our services to help businesses and consumers with digital banking tools. Stop by to find out more. We want to be your bank!

Freedom Bank is a main sponsor of the Open Rodeo at the Blue Moon Arena and a proud partner of the Columbia Falls Community Market.

Heritage Days is an adventure and celebration for the whole family. Take a look at the complete schedule below or visit the official Heritage Days website here:

https://www.cfallsheritagedays.com/events.html

Help the Wildcat/kat Athletic Endowment assist with the financial support of CFHS athletics.

Protecting yourself while shopping online is of utmost importance. In today’s digital age, it is crucial to stay vigilant and take necessary precautions to ensure a safe online shopping experience. Opt for trusted platforms and payment gateways that offer encryption and fraud protection. Additionally, be cautious of suspicious emails or websites that may attempt to steal your personal data. Always double-check the legitimacy of the sender or the website before sharing any sensitive information.

ction, you may notice that two letters have been swapped or there is a minor misspelling. If you encounter a spelling error in the domain name, it indicates that you are not on the official site, and it is advisable to close the tab.

ction, you may notice that two letters have been swapped or there is a minor misspelling. If you encounter a spelling error in the domain name, it indicates that you are not on the official site, and it is advisable to close the tab.The image shows a link that at first glance looks like it will take you to the Better Business Bureau, however, when you hover the cursor over the link you can see it will take you to the Freedom Bank website.

The Annual Snack Drive for Boys & Girls Clubs of Glacier Country is running from May 22nd to June 2nd, 2023.

Freedom Bank is accepting non-perishable donated snacks and juice boxes for the children of Boys & Girls Clubs of Glacier Country. Boys & Girls Clubs serve many school-aged children. They work with children after school during the school year. They also work with children during the summer all day. Snacks are always a wonderful way to fuel children so they can continue to learn.

Sizes of items do not have to be individual small sizes; large or bulk sizes are acceptable also.

All types of snacks are welcome. Here is a list to inspire (but not limit) your generosity:

Snack donations are being collected in the lobby of Freedom Bank at 930 9TH ST W in Columbia Falls.

Please contact the Bank with any questions by calling 406-892-1776 and asking for Amy.

Bank closures are in the news, which prompted us to address this topic for our customers and community.

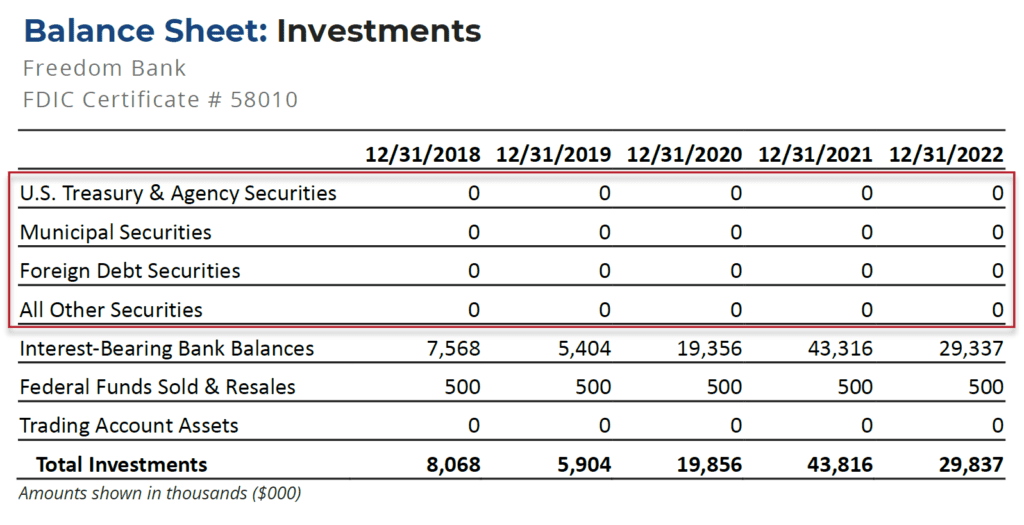

Freedom Bank does NOT hold an investment portfolio, and therefore we are not impacted by the strain faced by the financial institutions currently under scrutiny. Our institution is well capitalized and has plenty of accessible liquidity.

Freedom Bank operates under an entirely different business model than the institutions that were recently closed. Our relationship-based business model is rooted in building long-term trust with our deposit and loan customers. Our method of investment is in our local economy via our loan portfolio. We are a small business ourselves, and we take pride in serving the unique needs of our customers and community. Freedom Bank is in it for the long haul to serve the needs of those who count on us for financial stability and prosperity.

The information below is publicly available information about Freedom Bank’s balance sheet, specifically regarding investments. We are well positioned to meet the banking needs of our customers.

If you have questions or concerns, please stop by or call 406-892-1776 to speak with an Officer or Don Bennett, Freedom Bank President.

Here are some helpful links:

Source: Federal Financial Institutions Examination Council Central Data Repository’s Public Data Distribution

https://cdr.ffiec.gov/

A Freedom Bank debit card isn’t just a piece of plastic. It’s something that’s relied upon every day for groceries, gas, gifts, and so much more. Unfortunately, fraudsters are well aware that debit cards can allow them direct access to your bank account. To protect you from this, Freedom Bank utilizes state of the art fraud monitoring with a proactive, hands-on approach that keeps an eye on suspicious transactions. We know that sometimes this can be a frustrating and an inconvenient process for our customers and we are constantly trying to improve.

In response to the need for a more convenient form of fraud monitoring and notifying, we are introducing text alerts at the end of October. Text alerts are a brand-new debit card service feature that will increase card account security while decreasing instances of customers not being able to complete legitimate transactions.

FreeMSG Freedom Bank MT Fraud Center 888-XXX-XXXX $125.46 on card 1234 at Merchant ABC. If valid reply YES, fraud NO. To Opt Out, STOP.

FreeMSG Freedom Bank MT Fraud Center 888-XXX-XXXX Thank you for confirming this activity. You may continue to use your card. To Opt Out reply STOP.

You will be able complete your transaction by running your debit card one more time after receiving this message from Freedom Bank.

FreeMSG Freedom Bank MT Fraud Center 888-XXX-XXXX Your response has placed a block on the card. Call us immediately at 888-XXX-XXXX, avail 24/7. To Opt Out reply STOP.

Your card will be restricted until you either contact the fraud number provided in the message, or Freedom Bank at (406) 892-1776:

This feature is free to all card holders with a cell phone. To ensure you can take advantage of this new debit card feature please make sure all contact information is up to date with Freedom Bank. You can do this either by calling (406) 892-1776 or by stopping by the bank at 530 9th St. West Columbia Falls, MT. If you decide you do not want to receive further text messages, just text STOP to Opt Out.

Fake messages from scammers will look very similar to those sent by any financial institution. These messages are designed to scare or confuse you and create a sense of urgency usually the text message will reference high dollar amounts. These scammers want you to believe they are from Freedom Bank and will most likely have researched you beforehand. They may look like:

Free Msg- (Insert financial institution name here) Bank Fraud Alert- Did You Attempt an Instant Payment in the amount of $5,000.00? REPLY YES or NO or 1 To STOP ALERTS

If you reply ‘NO’ they will send a second message saying you will be contacted shortly.

When the scammer calls, they may:

The community celebration began in 1956 to mark the prosperity brought about by industrial expansion, which included the railroad, lumber business, and the Anaconda Aluminum Company.

Freedom Bank is honored to be a part of Columbia Falls’ growth over the past 17 years. Just like many of our customers, Freedom Bank is a small local business. To participate in this community and to be able to support and watch it grow has been inspiring.

Freedom Bank is a main sponsor of the Open Rodeo at the Blue Moon Arena, a team and prize sponsor for the 3 on 3 basketball tournament, and a sponsor of the Columbia Falls Community Market at the Coop.

Heritage Days is an adventure and celebration for the whole family. Take a look at the complete schedule below or visit the official website here: http://cfallsheritagedays.com/index.html